Turning Our Focus to New Crop

Feb 01, 2024

Zack Gardner

Grain Marketing and Origination Specialist

So, what are the bearish fundamentals that the market is continuously grinding lower on?

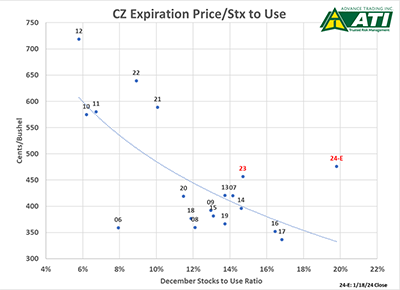

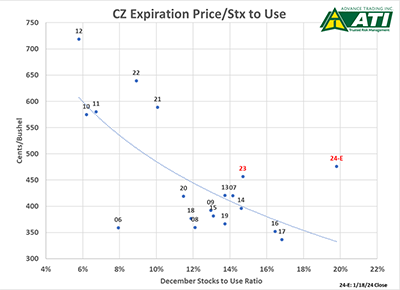

The red dot labeled “23” is the crop we just harvested. The other red dot labeled “24” is next year’s crop. According to this chart, our current crop is priced relatively accurately given our current market fundaments. This might explain why it seems like futures have stalled out for the time being in the $4.40’s. My big takeaway from this chart, however, is new crop. There is a huge price disparity between December ’24 futures and where it should be trading according to its fundamentals. Using a generic corn acreage number of 92.50 million with a yield of 178 bu/acre, December ’24 corn will have an approximate 19 percent stocks-to-use ratio. This basically means 1/5 of the corn we produce next year won’t be consumed! These fundamentals tell us that we will probably see corn around $3.75 come harvest.

If the fundamentals were so accurate, why aren’t we trading there already? We need to catch up on a lot of moisture here in Iowa first. Also, there is a big disparity between the USDA and most private analyst’s estimates for the safrinha corn crop down in Brazil (the USDA is approximately 10 MMT higher than most other analysts). Currently, the approximate $1.00 premium in December ’24 corn is probably factoring some of those stories in. So, what are we going to do about it? The fundamentals tell us to forward market next year’s crop aggressively, but the potential drought in our backyard says we might not have a crop.

There are several marketing tools out there that let us forward market our grain. They let us set a price floor in case the fundamentals turn out to be right, while still allowing for upside potential in case we do see a weather rally. Give the Key Cooperative Grain Team a call if you’d like to talk through some of these strategies. We are happy to talk grain and custom tailor strategies to your operation!

Grain Marketing and Origination Specialist

New Crop May Be The Greater Concern…

It seems as if this market just keeps grinding lower every day. In the absence of any news, it seems as if the market leans red. Even if we do get some positive news, it feels like we get one solid green day, followed by two or three in the red.The biggest reason for this is how bearish the world’s fundamentals are on paper. Why do I say, “on paper?” Barring a black swan event, basically our only bull story is a drought scare and it’s hard to trade a drought scare in the middle of January when we don’t have a crop in the ground yet.So, what are the bearish fundamentals that the market is continuously grinding lower on?

- The big January 12th USDA report raised both corn and soy production as well as stocks in the U.S.

- Argentina has recovered from last year’s drought and is on track to double last year’s production.

- Brazil’s crop estimates slowly get lowered each month, but as a whole, South American production will still be a record.

- As for new crop in the U.S., the funds traders are siding with our geneticists and anticipate us producing yet another crop in droughty conditions.

The red dot labeled “23” is the crop we just harvested. The other red dot labeled “24” is next year’s crop. According to this chart, our current crop is priced relatively accurately given our current market fundaments. This might explain why it seems like futures have stalled out for the time being in the $4.40’s. My big takeaway from this chart, however, is new crop. There is a huge price disparity between December ’24 futures and where it should be trading according to its fundamentals. Using a generic corn acreage number of 92.50 million with a yield of 178 bu/acre, December ’24 corn will have an approximate 19 percent stocks-to-use ratio. This basically means 1/5 of the corn we produce next year won’t be consumed! These fundamentals tell us that we will probably see corn around $3.75 come harvest.

If the fundamentals were so accurate, why aren’t we trading there already? We need to catch up on a lot of moisture here in Iowa first. Also, there is a big disparity between the USDA and most private analyst’s estimates for the safrinha corn crop down in Brazil (the USDA is approximately 10 MMT higher than most other analysts). Currently, the approximate $1.00 premium in December ’24 corn is probably factoring some of those stories in. So, what are we going to do about it? The fundamentals tell us to forward market next year’s crop aggressively, but the potential drought in our backyard says we might not have a crop.

There are several marketing tools out there that let us forward market our grain. They let us set a price floor in case the fundamentals turn out to be right, while still allowing for upside potential in case we do see a weather rally. Give the Key Cooperative Grain Team a call if you’d like to talk through some of these strategies. We are happy to talk grain and custom tailor strategies to your operation!