Still Bearish… for Now

Oct 01, 2024

Zack Gardner

Grain Marketing & Origination Specialist

In the past month, our soybeans have rallied approximately $1.00 per bushel off the bottom of the marketing year lows.

Click to view.

There have been three main drivers of this rally, and the gist of it is that the funds traders are nervous with their short positions. Those drivers are:

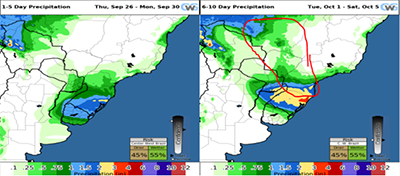

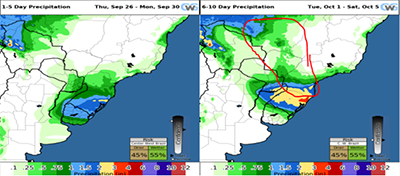

I can totally see why funds traders with short positions might be nervous and looking to buy out of their shorts, but Brazil is only approximately one percent behind in planting and there’s moisture creeping into the six-to-ten-day forecasts. Once these rains start materializing, I’m nervous that the market might go back to pricing in that record South American soybean crop.

After all, nothing about this $1.00 rally tells the South American farmer to plant fewer soybean acres.

Click to view.

Short-term, I’m still bearish. Our global soybean carryout (surplus production) is roughly the equivalent of the entire U.S. soybean crop.

Long-term, I’m hopeful. With the new legislation that was introduced the other day, it should limit the amount of used cooking oil from China or Canadian canola oil that makes its way into our biofuels market. If we get this biofuels and aviation fuel market right, not only will it completely offset the exports that we are losing to Brazil/China, but it should provide some incredible new and stable demand for our grain long term.

Have questions? Contact the Key Grain Team!

Grain Marketing & Origination Specialist

In the past month, our soybeans have rallied approximately $1.00 per bushel off the bottom of the marketing year lows.

Click to view.

There have been three main drivers of this rally, and the gist of it is that the funds traders are nervous with their short positions. Those drivers are:

- Dryness in Brazil (delaying soybean planting)

- China issuing new stimulus for their economy (and in theory leading to more commodity consumption)

- New biofuels legislation (Farmers First Fuel Incentive Act)

I can totally see why funds traders with short positions might be nervous and looking to buy out of their shorts, but Brazil is only approximately one percent behind in planting and there’s moisture creeping into the six-to-ten-day forecasts. Once these rains start materializing, I’m nervous that the market might go back to pricing in that record South American soybean crop.

After all, nothing about this $1.00 rally tells the South American farmer to plant fewer soybean acres.

Click to view.

Short-term, I’m still bearish. Our global soybean carryout (surplus production) is roughly the equivalent of the entire U.S. soybean crop.

Long-term, I’m hopeful. With the new legislation that was introduced the other day, it should limit the amount of used cooking oil from China or Canadian canola oil that makes its way into our biofuels market. If we get this biofuels and aviation fuel market right, not only will it completely offset the exports that we are losing to Brazil/China, but it should provide some incredible new and stable demand for our grain long term.

Have questions? Contact the Key Grain Team!