There’s No Excuse to Forget about Marketing

Aug 01, 2022

Zack Gardner

Grain Marketing & Origination Specialist

In the July article, I said I had many questions and few answers. Now that it’s August, we still don’t have many answers, but that doesn’t give us an excuse to forget about marketing.

At this point, there are a lot of unknowns. We still don’t really have answers from the questions we asked at the start of the growing season and we still haven’t figured out how the world will make up for Ukraine’s lack of production (despite grain prices being back at pre-war levels). With the USDA kicking the can down the road on acreage surveys in the Dakota’s, we don’t know what those fringe acres were planted with in late May, early June. And to top it all off, we aren’t any closer to knowing what yields will be this fall with the hot and dry forecast in front of us.

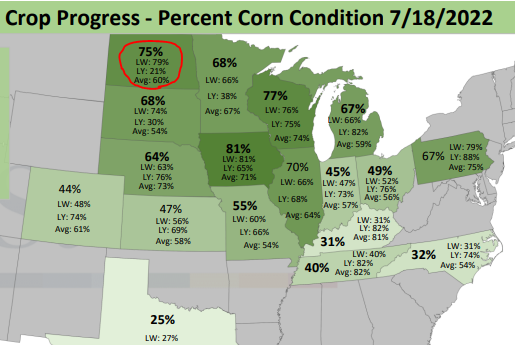

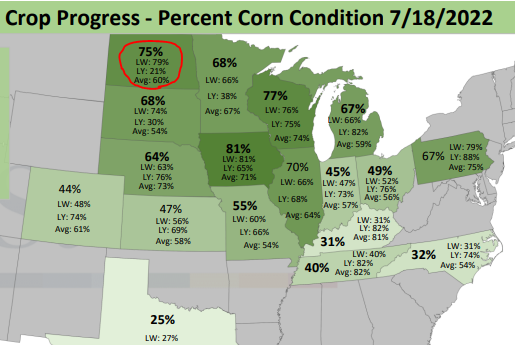

Whatever acres we do get, we should see some huge volatility swings due to current crop conditions. As of mid-July, North Dakota has the third best corn conditions in the US. If we do get some more corn acres, it will be multiplied by a phenomenal yield number.

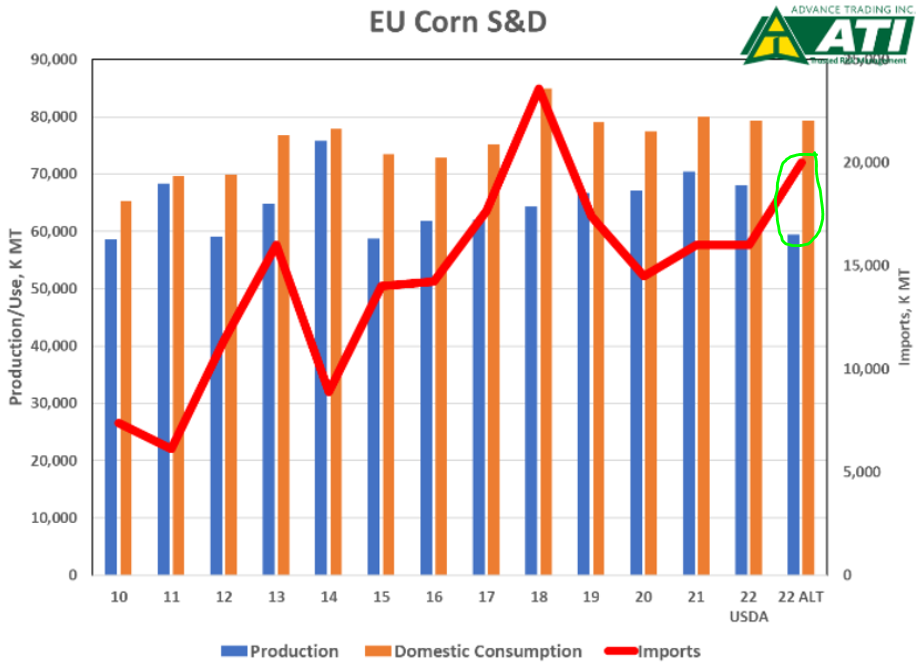

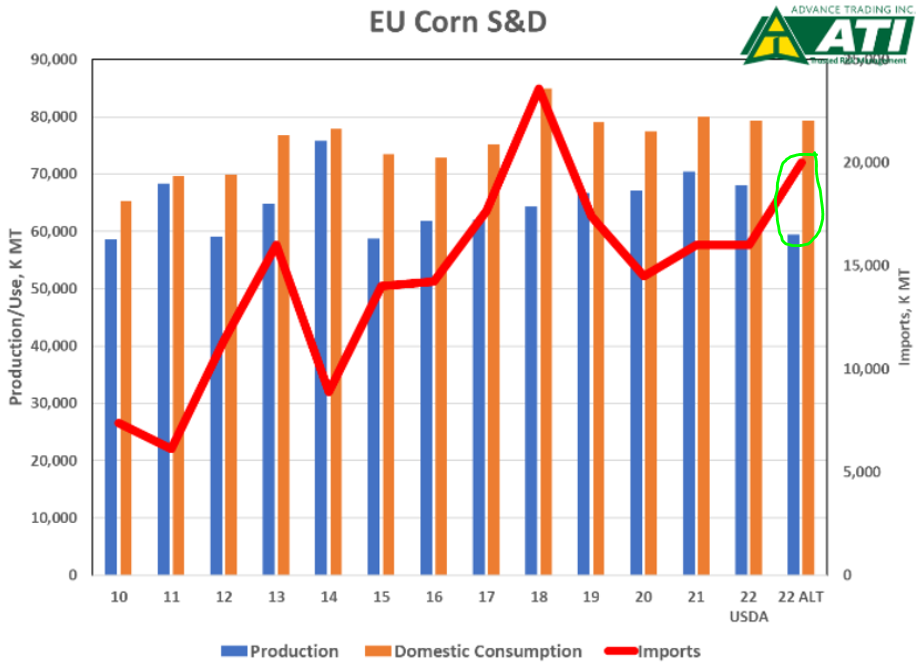

One bright spot in exports, however, might be the heat wave that’s going through Europe right now. Their governments are lowering production estimates as we speak, so that may mean they need to import from the US to make up for their loss in production. Circled in green on the chart below is roughly 160 million bushels that Europe may need to import.

In the meantime, we could start coming up with a plan for the rest of your bushels. It doesn’t have to be all of them. Maybe it’s a plan for the surplus bushels that you know will have to move during harvest and that you won’t want to pay storage on. Maybe it’s the amount up to your insurance level that you haven’t sold yet because of the hot and dry forecast. Now is the time to start thinking through a game plan for those bushels. If you aren’t comfortable selling, maybe we buy put options to at least cover our downside risk through the month of August until we find out more about acres and yield. Maybe we write a minimum price contract to create a price floor, but retain our upside potential in case this hot and dry weather persists. There are many strategies that can be utilized in this marketing environment and our grain team is happy to help you protect against price risk in the months ahead.

Grain Marketing & Origination Specialist

In the July article, I said I had many questions and few answers. Now that it’s August, we still don’t have many answers, but that doesn’t give us an excuse to forget about marketing.

At this point, there are a lot of unknowns. We still don’t really have answers from the questions we asked at the start of the growing season and we still haven’t figured out how the world will make up for Ukraine’s lack of production (despite grain prices being back at pre-war levels). With the USDA kicking the can down the road on acreage surveys in the Dakota’s, we don’t know what those fringe acres were planted with in late May, early June. And to top it all off, we aren’t any closer to knowing what yields will be this fall with the hot and dry forecast in front of us.

The USDA acreage resurvey

Whatever acres we do get, we should see some huge volatility swings due to current crop conditions. As of mid-July, North Dakota has the third best corn conditions in the US. If we do get some more corn acres, it will be multiplied by a phenomenal yield number.

Exports are running behind

One bright spot in exports, however, might be the heat wave that’s going through Europe right now. Their governments are lowering production estimates as we speak, so that may mean they need to import from the US to make up for their loss in production. Circled in green on the chart below is roughly 160 million bushels that Europe may need to import.

We can’t forget about marketing

In the meantime, we could start coming up with a plan for the rest of your bushels. It doesn’t have to be all of them. Maybe it’s a plan for the surplus bushels that you know will have to move during harvest and that you won’t want to pay storage on. Maybe it’s the amount up to your insurance level that you haven’t sold yet because of the hot and dry forecast. Now is the time to start thinking through a game plan for those bushels. If you aren’t comfortable selling, maybe we buy put options to at least cover our downside risk through the month of August until we find out more about acres and yield. Maybe we write a minimum price contract to create a price floor, but retain our upside potential in case this hot and dry weather persists. There are many strategies that can be utilized in this marketing environment and our grain team is happy to help you protect against price risk in the months ahead.